Warning: Trying to access array offset on value of type bool in /home/cinchadv/public_html/wp-content/plugins/swift-framework/includes/page-builder/shortcodes/row.php on line 161

Warning: Trying to access array offset on value of type bool in /home/cinchadv/public_html/wp-content/plugins/swift-framework/includes/page-builder/shortcodes/row.php on line 161

Warning: Trying to access array offset on value of type bool in /home/cinchadv/public_html/wp-content/plugins/swift-framework/includes/page-builder/shortcodes/row.php on line 161

Warning: Trying to access array offset on value of type bool in /home/cinchadv/public_html/wp-content/plugins/swift-framework/includes/page-builder/shortcodes/row.php on line 161

Warning: Trying to access array offset on value of type bool in /home/cinchadv/public_html/wp-content/plugins/swift-framework/includes/page-builder/shortcodes/row.php on line 161

Are you unknowingly exposing your family empire to your business’ risks? You might want to tune in.

In case you missed it, last week we outlined the four most common Australian business structures and the personal risk with each. In this blog, we’ll explore how you can use Trusts and Company structures to protect your assets.

How Your Business Structure Affects Your Personal Risk

Being in business should be fun, right?

You took that bold, brave step to start your own business, create a legacy, and retire at 45 with a solid gold bank account and yacht permanently docked in Monaco. We hear you.

But, did you realise your choice of business structure can positively or negatively influence your financial well-being? Yep! So, it’s important you choose the right one for your #dreams.

How to Separate Your Assets from Your Business Risks

If you’re determined to retire with your gold and your yacht (or, even just financially secure), you’ll want to make sure your family’s wealth, super, property, and assets are separated from your business.

Structuring your business as a Trust or Company is the only way to protect your assets from your business liabilities (debts and losses). Here’s how to do it:

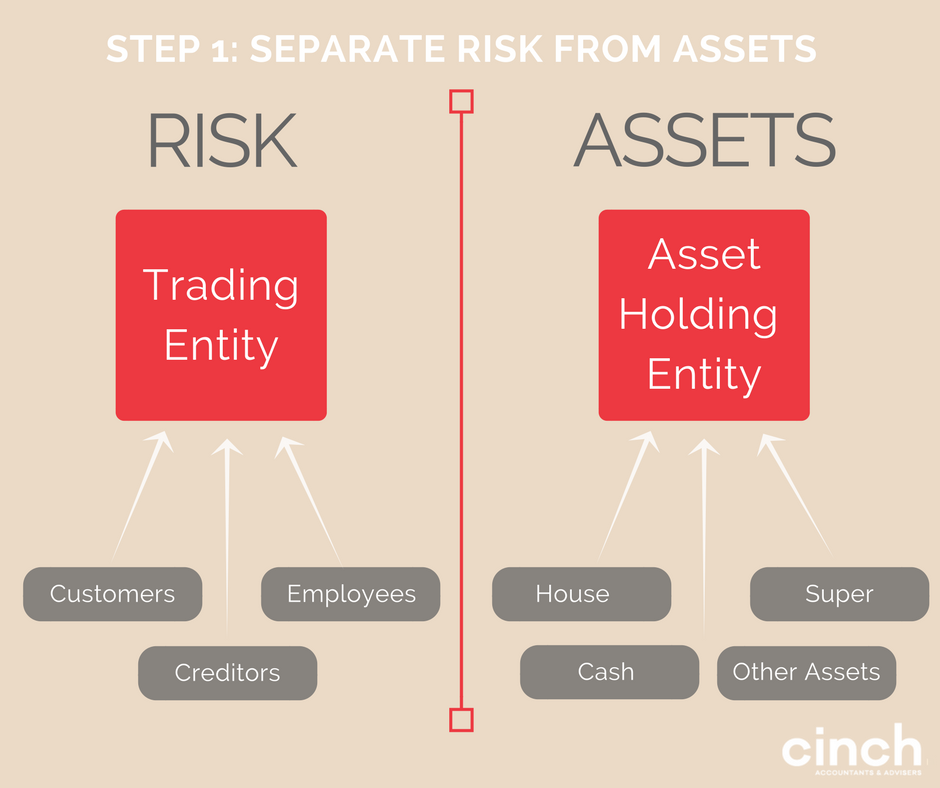

Step 1: Separate Your Risks From Your Assets

You should always keep your business risks separate from your assets. And when running a business, you have “risk” whenever you enter a business relationship with clients, suppliers, or employees.

How is your business currently structured?

For example: If you’re a Sole Trader, you’re personally liable for any debts, losses, or litigation arising from your business relationships / “risks.” Say you owe your employees pay for work completed, yet one of your customers has disputed an invoice and ‘disappeared,’ leaving a big, black hole in your budget – you’re still personally liable for that payment. And, if you don’t have the cash, well, your mortgage will do here (goodbye fancy yacht!).

The first step in asset protection is ensuring you have a trading entity and a separate asset holding entity. And, the asset holding entity should never have “business relationships” – it should only invest or loan funds to related entities to effectively separate your risks from assets.

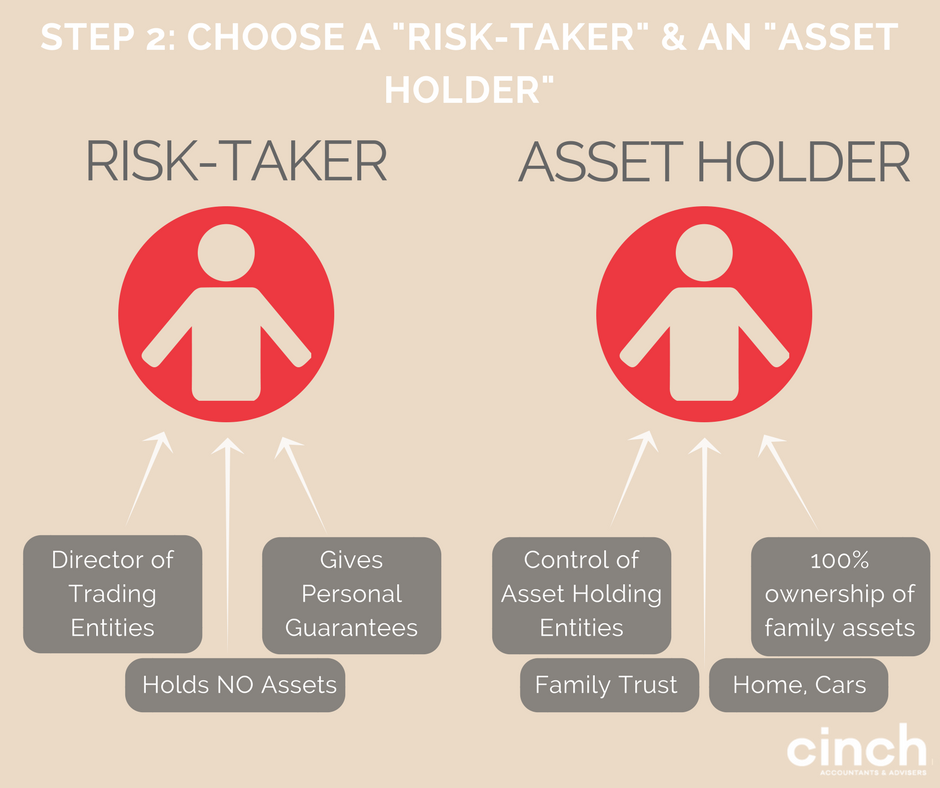

Step 2: Choose a ‘Risk Taker’ and an ‘Asset Holder’ for Your Personal Assets

Within a family group, you should choose one person to be the ‘risk taker’ and another to be the ‘asset holder.’ The ‘risk taker’ should be the main person involved in your business, the Director of your trading companies, and the only one giving personal guarantees.

On paper, the ‘risk taker’ is an unattractive target to take legal action against. As in, there’s nothing to their name. No assets, super, or property to target.

The ‘asset holder’ therefore, takes control of any asset holding entities, like a family trust. In most cases, the family home and cars should be 100% owned by the ‘asset holder.’

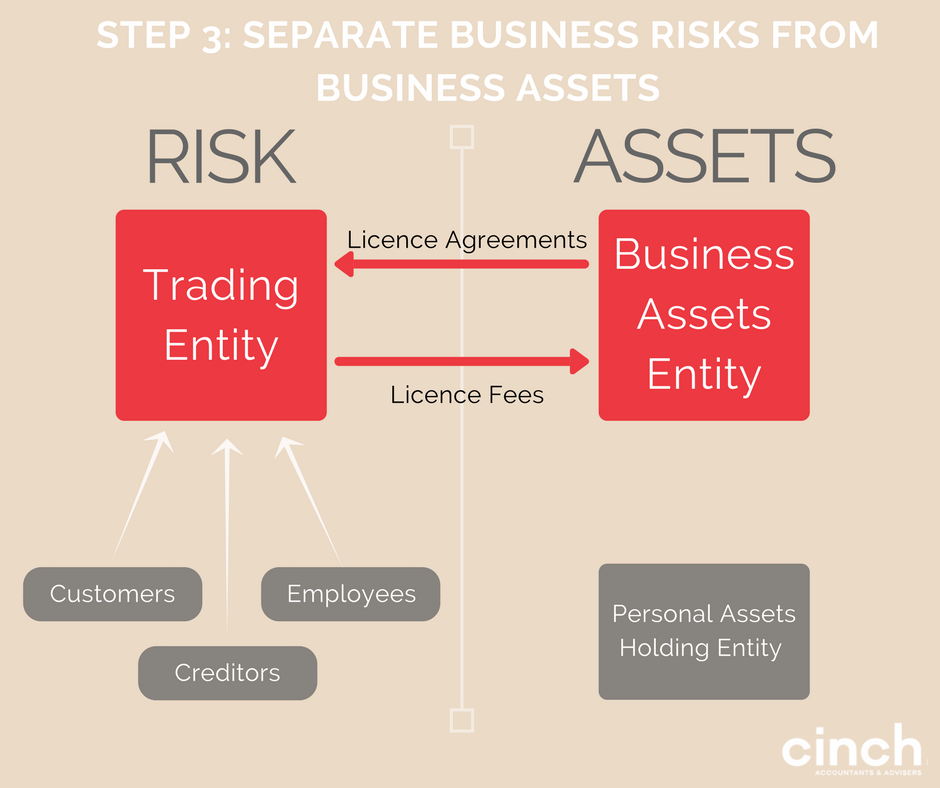

Step 3: Separate Business Risks from Business Assets

Now, you establish a business asset holding entity that’s separate from your personal asset holding entity.

You’ll transfer all business intellectual property, trademarks, patents, plant, and equipment to your business asset holding entity. Note: Your new entity should only have relationships with the trading entity. We then establish a licence or service agreement to licence the use of these assets from the Business Asset Holding Entity to the Trading Entity.

The benefit in a separate business asset holding entity is that, should your trading entity fail, your business assets should be protected from any fallout.

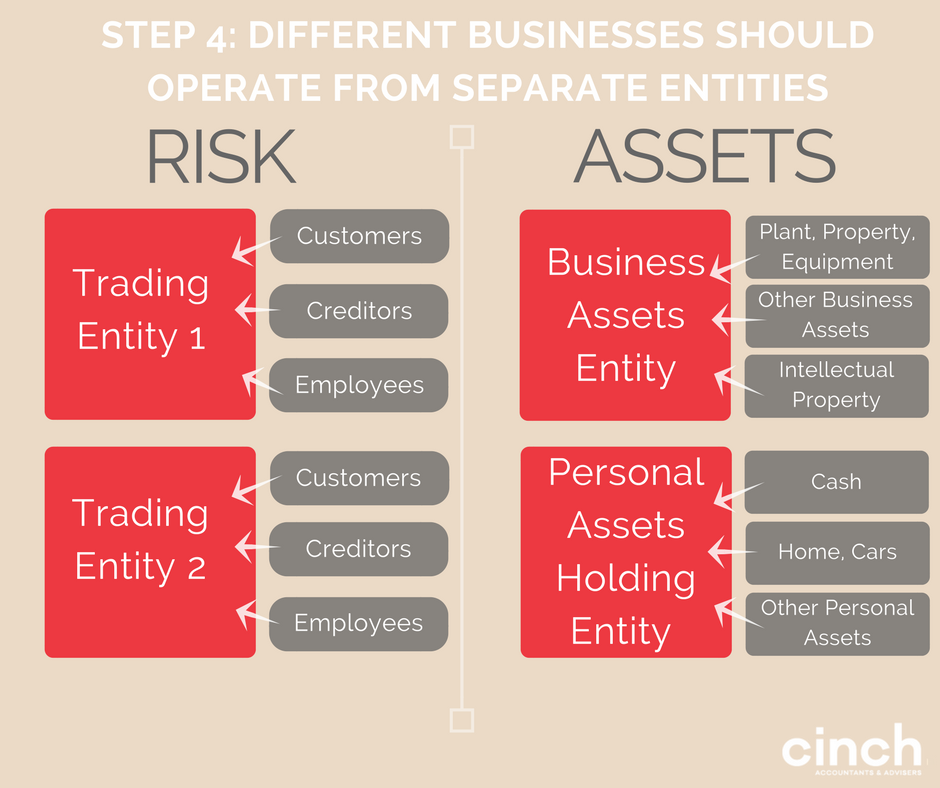

Step 4: Different Businesses Operate from Separate Entities

You must ensure your different businesses operate from their own entities. You don’t want the failure of one business or division to affect the viability of your other business ventures. That’s just plain silliness, Captain Risky.

If water leaks into a Submarine, the compartment can be “locked-off” to prevent water getting into other compartments and sinking the submarine. In the same way, if problems develop within a business, you should be able to “lock-off” the failing division from the other more successful divisions so that the whole submarine doesn’t sink.

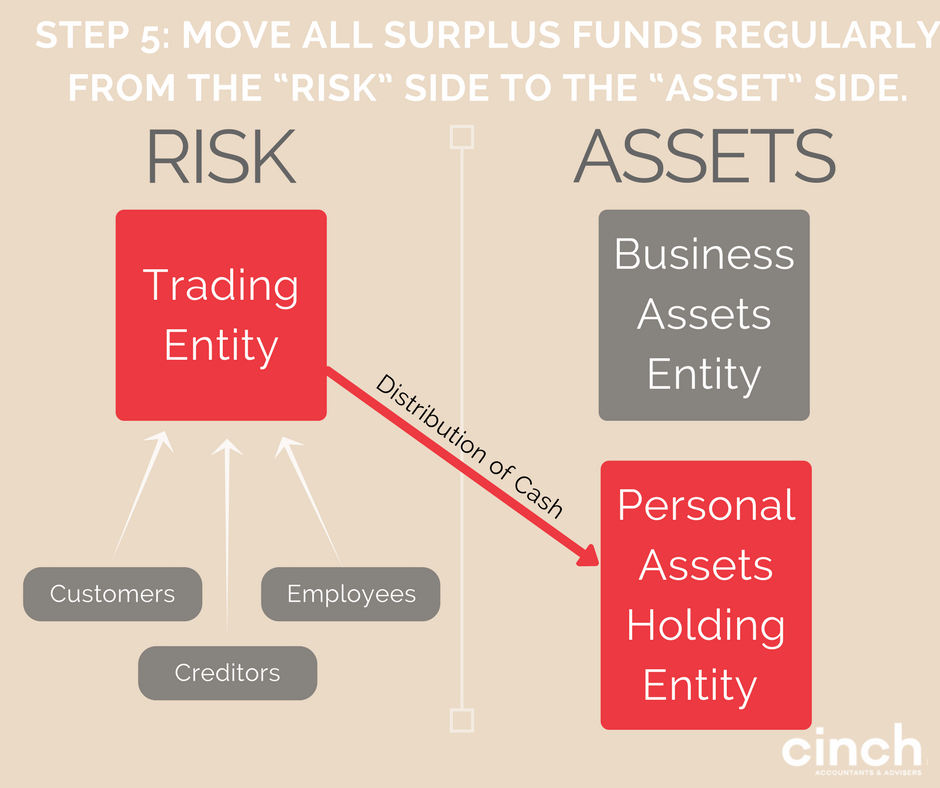

Step 5: Move All Surplus Funds Regularly from the “Risk” Side to the “Asset” Side.

We should all be so lucky to have strong profits that deliver us surplus funds each month. Maybe that Mediterranean yacht isn’t such a #pipedream.

You want to ensure your excess income from the trading entity doesn’t remain in the business as ‘working capital.’ Move it out. Like, now.

Because, if there’s any legal action taken against your business, then that extra cash you have sitting all pretty there is ripe for the picking. Obviously, ensure your trading entity has the minimum assets you need (cash, debtors, and stock) and no outstanding loans before you move any money.

Fully distribute any remaining profits into your asset holding trust and lend it back to your trading entity as needed under a Secure Loan Agreement. Sure, there’s a bit more paperwork this way, but at least you’re not at risk of losing your profits in a plume of smoke. Puff.

A GREAT Accountant Makes This Seem a Lot Less Complex

Sure – this all looks fantastic in theory. Who doesn’t want to set up their business with minimal personal risk and more financial security?

Companies and Trusts are complex structures and cost a bit to be set up correctly. They’re not for everyone – but, if you’re running a business or building personal wealth, don’t go putting it at risk with the wrong legal structure.

It’s important you talk to your accountant and determine the best structure that will protect your assets and your lifestyle.

Get in touch for an obligation-free chat today, and start protecting your future.